Business/Markets/Stocks/Economics Random, Random

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

I don't know the symbols or names of the Asian markets well but I do know the Nikkei is Japan and things don't look so good right now.

Stock Indexes

SYMBOL PRICE CHANGE %CHANGE

*SHANGHAI

3,223.64 UNCH UNCH

*NIKKEI

32,864.28 -1,744.72 -5.04

*HSI

20,681.78 UNCH UNCH

*SHENZHEN

9,754.64 UNCH UNCH

*KOSPI

2,396.52 -48.54 -1.99

*ASX 200

7,539.5 -170.1 -2.21

*NIFTY 50

22,399.15 UNCH UNCH

*STI

3,577.83 +184.14 +5.43

*SGX-CNBC China Growth

1,372.11 +0.13 +0.01

*CNBC 100

9,306.69 -176.43 -1.86

NZX 50

12,026.66 -174.77 -1.43

*.SETI

1,133.95 UNCH UNCH

*MALAYSIA

1,463.13 UNCH UNCH

*TAIWAN

19,000.03 UNCH UNCH

Stock Indexes

SYMBOL PRICE CHANGE %CHANGE

*SHANGHAI

3,223.64 UNCH UNCH

*NIKKEI

32,864.28 -1,744.72 -5.04

*HSI

20,681.78 UNCH UNCH

*SHENZHEN

9,754.64 UNCH UNCH

*KOSPI

2,396.52 -48.54 -1.99

*ASX 200

7,539.5 -170.1 -2.21

*NIFTY 50

22,399.15 UNCH UNCH

*STI

3,577.83 +184.14 +5.43

*SGX-CNBC China Growth

1,372.11 +0.13 +0.01

*CNBC 100

9,306.69 -176.43 -1.86

NZX 50

12,026.66 -174.77 -1.43

*.SETI

1,133.95 UNCH UNCH

*MALAYSIA

1,463.13 UNCH UNCH

*TAIWAN

19,000.03 UNCH UNCH

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Carl Quintanilla

@carlquintanilla.bsky.social

JPMORGAN: To argue that today’s 145% China tariff clarification “is somehow less of a shock as a result is very misguided .. The sudden stop of roughly $450bn in US imports and the resulting disruption to US supply chains would be a significant blow .. We maintain our call for a US recession ..”

@carlquintanilla.bsky.social

JPMORGAN: To argue that today’s 145% China tariff clarification “is somehow less of a shock as a result is very misguided .. The sudden stop of roughly $450bn in US imports and the resulting disruption to US supply chains would be a significant blow .. We maintain our call for a US recession ..”

ETTDmellatinvegan.bsky.social @mellatinvegan.bsky.social

·

2h

How did we go from the strongest economy in the planet to we are so close to recession in just 4 months ???

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Europe Markets

Stock Indexes

SYMBOL PRICE CHANGE %CHANGE

*IBEX 35

12,307.6 +510 +4.32

*FTSE

7,913.25 +233.77 +3.04

*DAX

20,562.73 +891.85 +4.53

*CAC

7,126.02 UNCH UNCH

*STOXX600

487.28 +17.39 +3.7

*AEX

819.24 UNCH UNCH

*BEL 20

3,985.61 UNCH UNCH

*FTSE MIB

34,277.09 +1,546.52 +4.73

OMXS30

2,280.57 +104.81 +4.82

*SMI

11,244.59 +356.86 +3.28

HEX

9,159.19 +317.28 +3.59

*PSI20

6,404.79 UNCH UNCH

OMXC 25

1,503.7 +65.45 +4.55

https://www.cnbc.com/europe-markets/

Stock Indexes

SYMBOL PRICE CHANGE %CHANGE

*IBEX 35

12,307.6 +510 +4.32

*FTSE

7,913.25 +233.77 +3.04

*DAX

20,562.73 +891.85 +4.53

*CAC

7,126.02 UNCH UNCH

*STOXX600

487.28 +17.39 +3.7

*AEX

819.24 UNCH UNCH

*BEL 20

3,985.61 UNCH UNCH

*FTSE MIB

34,277.09 +1,546.52 +4.73

OMXS30

2,280.57 +104.81 +4.82

*SMI

11,244.59 +356.86 +3.28

HEX

9,159.19 +317.28 +3.59

*PSI20

6,404.79 UNCH UNCH

OMXC 25

1,503.7 +65.45 +4.55

https://www.cnbc.com/europe-markets/

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Click for the video

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Video at the link.

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

Suliso

- Posts: 5641

- Joined: Fri Dec 11, 2020 2:30 pm

- Location: Basel, Switzerland

- Has thanked: 316 times

- Been thanked: 1771 times

Re: Business/Markets/Stocks/Economics Random, Random

While it's true that in a five year time frame market is almost always up it's not necessarily true for individual companies, even large and famous ones. For example had you invested in Nike in April 2020 you'd be now down 37%.

-

Suliso

- Posts: 5641

- Joined: Fri Dec 11, 2020 2:30 pm

- Location: Basel, Switzerland

- Has thanked: 316 times

- Been thanked: 1771 times

Re: Business/Markets/Stocks/Economics Random, Random

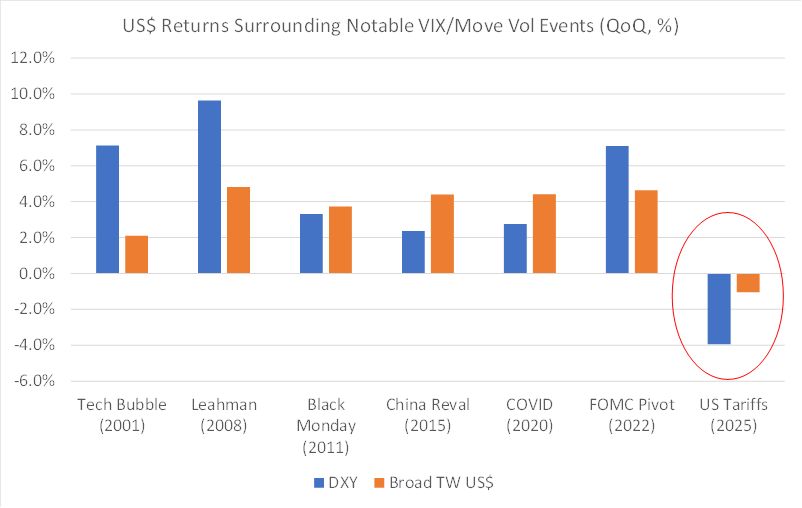

Now 145% tariff for Chinese goods in USA and 125% tariff on American goods in China. This will be "fun" for everyone involved and perhaps bystanders as well. Meanwhile the dollar keeps sliding lower and lower...

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Don't forget the bond market...

Dr_Dick_Dastardly

•

1d ago

Everyone finally realized that nothing fundamentally changed. The US still has tariffs on everyone and an insane policy with China. Plus the crazy and impulsive people are still in charge and can flip the tariff switch back whenever they want.

The 5D-chess playing President literally told everyone the bond market is what they were looking at to monitor success or failure. The bond collapse terrified them, so they backed off. Every nation on earth heard that and realized that dumping bonds is the way to win the trade war and seize up the US economy at the same time. It's why he is a master of the art of the deal.

Broccoli-of-Doom

•

1d ago

Indeed. It looks like the selling was largely by Japan, which means China hadn't even started using their leverage yet...

geekfreak42

•

1d ago

japan has 50% more Us debt than china

japan, china, uk, luxembourg, cayman islands. in order of us national debt held

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Katie Martin

@katie0martin.ft.com

Follow

What the dollar normally does in a crisis vs what it's doing now, via RBC

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

I...

State of Freight

Trump tariff collection for freight shipments delayed by Customs ‘glitch’

Published Fri, Apr 11 20251:03 PM EDTUpdated 4 Hours Ago

Lori Ann LaRocco

Key Points

An alert by U.S. Customs notified shippers of a glitch in the system regarding the code to exempt all freight that was on the water this week and should be exempt from any new Trump tariffs, including freight already on the way from China and any nations now under a 90-day reprieve.

It’s the latest blow to U.S. importers and a supply chain already dealing with uncertainty and fearing trade chaos.

“Social media posts are not law on the pause and increase in tariffs. With the constant changes to the regulations, all customs brokers in our industry have a difficult task ahead of them,” one logistics executive tells CNBC.

An alert from U.S. Customs and Border Protection on Friday notified users of a glitch in the system that is used to exempt freight from tariffs, including shipments from China that were already on the water at the time of this week’s whipsaw in tariffs policy, and any trade from nations now under the 90-day pause put in place by the Trump administration.

The alert explained that U.S. Customs discovered that the entry code for U.S. shippers to use to have their freight exempted is not working and “the issue is being reviewed.”

In the alert, Customs advised filers “to transmit cargo release separately and follow up with the summary filing when resolved.”

Normally, when a U.S. importer pays for their freight, they file both the cargo release forms and their financial papers, so they can pay for their cargo. To keep the cargo moving, Customs is advising importers to file the cargo release form now, and file the financial form later, once the glitch is corrected.

For now, that means the tariffs are not being collected by the U.S. government.

The tariffs being paused on many nation’s trade, and the Chinese tariffs still in effect, are based on the sailing date, or the date the freight leaves the factory or warehouse. This is called an “on the water” clause and is in effect for all freight bound to the U.S. that has been on the water before the April 5, 9, and 10 tariff announcements.

The on the water clause has not changed, even though the China tariff percentages have increased to 145% and a series of other recent tariffs have been put in place.

CBP said it will issue an update when this issue is resolved.

For U.S. shippers and the supply chain, it’s the latest blow at a time of uncertainty and fear about tariffs policy. It also raises questions about Customs ability to handle the new policy and collect the tariffs revenue that is key to Trump administration economic goals.

Interpretations of the multiple executive orders, social media posts, and customs alerts have some U.S. companies and industry groups trying to figure out when the new tariffs will be deployed.

“There has been some confusion on what President Trump has said in social media posts on when the tariff starts and what is written in the executive order,” said Jarred Varanelli, vice president of US sales at logistics firm Savino Del Bene. “Social media posts are not law on the pause and increase in tariffs. With the constant changes to the regulations, all customs brokers in our industry have a difficult task ahead of them.”

Despite President Trump saying numerous times tariffs are in effect and being collected, U.S. shippers tell CNBC they have not been charged higher tariff rates on their containers, some of which came in as late as yesterday.

Dewardric McNeal, managing director and senior policy analyst at Longview Global with a focus on international trade, foreign affairs and defense, tells CNBC glitches do happen, but the timing is unfortunate and will lead to more questions about Customs’ ability to keep up with the pace of the tariffs.

“Whether you agree or disagree with the policy, you have to ask, do we have the ability to do it this rapidly?” said McNeal. “This glitch may be an indication we need more time. It seems odd this is the time it happens. This adds policy chaos for the implementer.”

To keep the freight moving, Customs is telling firms to pay the duties and tariffs within ten days of the cargo’s release to Customs, by which time it expects the glitch should be fixed.

“It’s a mess, to simply state it,” said McNeal. “I don’t think it will slow down goods. But it will increase the paperwork for the U.S. companies who are suffering tariff whiplash. These companies will need to refile that at a later date. Trade will flow but at greater complexity.”

The U.S. is currently at work on negotiations with over 75 countries on tariffs deals that Trump has said will be tailored to each nation.

The uncertainty at Customs entry points come within the context of much greater business anxiety.

Rick Woldenberg, CEO of Learning Resources, a three-generation educational toy company which makes its products in China, said this year it was scheduled to expand with the construction of a new building, but now he is pausing expansion and reviewing his company’s financials to see where cuts can be made.

“I cannot run my business based on social media posts,” said Woldenberg. “This is making it difficult for me to make my business decisions. Instead of planning on growth, I’m talking about surviving. This trade policy can kill me and hundreds of small businesses like me. This will eliminate jobs. The banking industry and insurance industry that serve businesses both large and small will be impacted if companies go bankrupt.”

Woldenberg expects massive disruption. “The interconnectedness of all of this is not well understood. This policy was crafted with little interest in the details. It’s these details that will drive business and the economy down the toilet.”

https://www.cnbc.com/2025/04/11/customs ... tions.html

State of Freight

Trump tariff collection for freight shipments delayed by Customs ‘glitch’

Published Fri, Apr 11 20251:03 PM EDTUpdated 4 Hours Ago

Lori Ann LaRocco

Key Points

An alert by U.S. Customs notified shippers of a glitch in the system regarding the code to exempt all freight that was on the water this week and should be exempt from any new Trump tariffs, including freight already on the way from China and any nations now under a 90-day reprieve.

It’s the latest blow to U.S. importers and a supply chain already dealing with uncertainty and fearing trade chaos.

“Social media posts are not law on the pause and increase in tariffs. With the constant changes to the regulations, all customs brokers in our industry have a difficult task ahead of them,” one logistics executive tells CNBC.

An alert from U.S. Customs and Border Protection on Friday notified users of a glitch in the system that is used to exempt freight from tariffs, including shipments from China that were already on the water at the time of this week’s whipsaw in tariffs policy, and any trade from nations now under the 90-day pause put in place by the Trump administration.

The alert explained that U.S. Customs discovered that the entry code for U.S. shippers to use to have their freight exempted is not working and “the issue is being reviewed.”

In the alert, Customs advised filers “to transmit cargo release separately and follow up with the summary filing when resolved.”

Normally, when a U.S. importer pays for their freight, they file both the cargo release forms and their financial papers, so they can pay for their cargo. To keep the cargo moving, Customs is advising importers to file the cargo release form now, and file the financial form later, once the glitch is corrected.

For now, that means the tariffs are not being collected by the U.S. government.

The tariffs being paused on many nation’s trade, and the Chinese tariffs still in effect, are based on the sailing date, or the date the freight leaves the factory or warehouse. This is called an “on the water” clause and is in effect for all freight bound to the U.S. that has been on the water before the April 5, 9, and 10 tariff announcements.

The on the water clause has not changed, even though the China tariff percentages have increased to 145% and a series of other recent tariffs have been put in place.

CBP said it will issue an update when this issue is resolved.

For U.S. shippers and the supply chain, it’s the latest blow at a time of uncertainty and fear about tariffs policy. It also raises questions about Customs ability to handle the new policy and collect the tariffs revenue that is key to Trump administration economic goals.

Interpretations of the multiple executive orders, social media posts, and customs alerts have some U.S. companies and industry groups trying to figure out when the new tariffs will be deployed.

“There has been some confusion on what President Trump has said in social media posts on when the tariff starts and what is written in the executive order,” said Jarred Varanelli, vice president of US sales at logistics firm Savino Del Bene. “Social media posts are not law on the pause and increase in tariffs. With the constant changes to the regulations, all customs brokers in our industry have a difficult task ahead of them.”

Despite President Trump saying numerous times tariffs are in effect and being collected, U.S. shippers tell CNBC they have not been charged higher tariff rates on their containers, some of which came in as late as yesterday.

Dewardric McNeal, managing director and senior policy analyst at Longview Global with a focus on international trade, foreign affairs and defense, tells CNBC glitches do happen, but the timing is unfortunate and will lead to more questions about Customs’ ability to keep up with the pace of the tariffs.

“Whether you agree or disagree with the policy, you have to ask, do we have the ability to do it this rapidly?” said McNeal. “This glitch may be an indication we need more time. It seems odd this is the time it happens. This adds policy chaos for the implementer.”

To keep the freight moving, Customs is telling firms to pay the duties and tariffs within ten days of the cargo’s release to Customs, by which time it expects the glitch should be fixed.

“It’s a mess, to simply state it,” said McNeal. “I don’t think it will slow down goods. But it will increase the paperwork for the U.S. companies who are suffering tariff whiplash. These companies will need to refile that at a later date. Trade will flow but at greater complexity.”

The U.S. is currently at work on negotiations with over 75 countries on tariffs deals that Trump has said will be tailored to each nation.

The uncertainty at Customs entry points come within the context of much greater business anxiety.

Rick Woldenberg, CEO of Learning Resources, a three-generation educational toy company which makes its products in China, said this year it was scheduled to expand with the construction of a new building, but now he is pausing expansion and reviewing his company’s financials to see where cuts can be made.

“I cannot run my business based on social media posts,” said Woldenberg. “This is making it difficult for me to make my business decisions. Instead of planning on growth, I’m talking about surviving. This trade policy can kill me and hundreds of small businesses like me. This will eliminate jobs. The banking industry and insurance industry that serve businesses both large and small will be impacted if companies go bankrupt.”

Woldenberg expects massive disruption. “The interconnectedness of all of this is not well understood. This policy was crafted with little interest in the details. It’s these details that will drive business and the economy down the toilet.”

https://www.cnbc.com/2025/04/11/customs ... tions.html

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

So… what was that pump about today?

There are growing suspicions that we witnessed another round of shady overnight activity — similar to what happened Wednesday night. Rumors were swirling that some major deal with China was supposed to be announced today, something that would “magically” turn the market around again.

But… something went wrong.

The Chinese president didn’t respond to Trump. The news didn’t drop. And just like that, the market couldn’t hold its gains.

Looks like insiders got trapped — front-running a narrative that never materialized. This kind of manipulation is becoming way too obvious. Who else is watching this unfold?

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

r/stocks

•

8 hr. ago

Jshbone12

The US bond market is continuing to crash. Will this make Trump back off of China?

Advice Request

Bond yields peaked right before Trump paused his tariffs. Trump himself even said he paused because the bond markets were getting “yippy” and lots of sources say the bond market crash was his main reason for the pause.

Today bond yields have spiked just as high as they were when Trump enacted his 90 day pause. He clearly cares about this measure given the action he took a few days ago. Could this continued sell off on bonds cause Trump to back off of China?

According the the FT, ten minutes ago, talking about bond yields today: “They point to a complete loss of faith in the strongest bond market in the world.”

I know I’m the one who asked the question, but in my opinion it seems like there’s a decent chance this will cause Trump to back off, because otherwise this will lead to a much larger crisis, with the U.S losing its reserve currency status and the debt becoming more expensive than whatever we may generate from tariffs. He already backed off once for the same reason….

•

8 hr. ago

Jshbone12

The US bond market is continuing to crash. Will this make Trump back off of China?

Advice Request

Bond yields peaked right before Trump paused his tariffs. Trump himself even said he paused because the bond markets were getting “yippy” and lots of sources say the bond market crash was his main reason for the pause.

Today bond yields have spiked just as high as they were when Trump enacted his 90 day pause. He clearly cares about this measure given the action he took a few days ago. Could this continued sell off on bonds cause Trump to back off of China?

According the the FT, ten minutes ago, talking about bond yields today: “They point to a complete loss of faith in the strongest bond market in the world.”

I know I’m the one who asked the question, but in my opinion it seems like there’s a decent chance this will cause Trump to back off, because otherwise this will lead to a much larger crisis, with the U.S losing its reserve currency status and the debt becoming more expensive than whatever we may generate from tariffs. He already backed off once for the same reason….

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Trump spares smartphones, computers, other electronics from China tariffs

By David Lawder and Jeff Mason

April 12, 20257:05 PM EDT Updated a min ago

Summary

Semiconductors, flat-panel displays excluded from Trump's reciprocal tariffs

Tech company CEOs embracing Trump in second administration

Trump's 20% fentanyl-related tariffs remain on all Chinese imports

Latest tariff exclusions suggest growing awareness of consumer pain

Smartphones, laptops were largest US imports from China in 2024

WASHINGTON/WEST PALM BEACH, Florida, April 12 (Reuters) - President Donald Trump's administration granted exclusions from steep reciprocal tariffs to smartphones, computers and some other electronics imported largely from China, providing a big break to tech companies like Apple that rely on imported products.

In a notice to shippers...the U.S. Customs and Border Protection agency published a list of tariff codes excluded from the import taxes. The exclusions are retroactive to 12:01 a.m. EDT (0401 GMT) on April 5.

The U.S. CBP listed 20 product categories, including the broad 8471 code for all computers, laptops, disc drives and automatic data processing. It also included semiconductor devices, equipment, memory chips and flat panel displays.

The notice did not provide an explanation for the move, but the late-night exclusion provides welcome relief to major technology firms such as Apple (AAPL.O), opens new tab, Dell Technologies (DELL.N), opens new tab and many other importers.

Trump's action also excludes the specified electronics from his 10% "baseline" tariffs on goods from most countries other than China, easing import costs for semiconductors from Taiwan and Apple iPhones produced in India.

Wedbush Securities analyst Dan Ives called the announcement "the most bullish news we could have heard this weekend."

"There is still clear uncertainty and volatility ahead with these China negotiations.... Big Tech firms like Apple, Nvidia, Microsoft and the broader tech industry can breathe a huge sigh of relief this weekend into Monday," Ives said in an industry note.

Many tech company CEOs have embraced Trump as he begins his second term, attending his January 20 inauguration in Washington and celebrating with him afterward. Apple CEO Tim Cook hosted a pre-inaugural ball and has visited Trump at his home in Florida.

For the Chinese imports, the exclusion only applies to Trump's reciprocal tariffs, which climbed to 125% this week, according to a White House official. Trump's prior 20% duties on all Chinese imports that he said were related to the U.S. fentanyl crisis remain in place.

But the official said Trump will launch a new national security trade investigation into semiconductors soon that could lead to other new tariffs.

White House spokesperson Karoline Leavitt said in a statement that Trump has made clear the U.S. cannot rely on China to manufacture critical technologies such as semiconductors, chips, smartphones and laptops.

But she said that at Trump's direction, major tech firms, including Apple and chipmakers Nvidia (NVDA.O), opens new tab and Taiwan Semiconductor (2330.TW), opens new tab "are hustling to onshore their manufacturing in the United States as soon as possible."

Step chart showing the rising tariff rates imposed by the U.S. and China against each other since February 1.

TARIFF PAIN

The exemptions suggest an increasing awareness within the Trump administration of the pain his tariffs could inflict on inflation-weary consumers.

Even at a lower 54% tariff rate on Chinese imports, analysts predicted the price of a top-end Apple iPhone could jump to $2,300 from $1,599. At 125%, economists and analysts have said U.S.-China trade could largely halt.

Smartphones were the top U.S. import from China in 2024, totaling $41.7 billion, while Chinese-built laptops were second, at $33.1 billion, according to U.S. Census Bureau data.

Apple recently chartered cargo flights to ferry 600 tons of iPhones, or as many as 1.5 million, to the U.S. from India, after it stepped up production there in an effort to beat Trump's tariffs, Reuters reported on Friday.

Trump campaigned to win back the White House last year largely on a promise to bring down prices that, fueled by inflation that tarnished the economic reputation of former President Joe Biden and his Democratic allies.

But Trump also promised to impose the tariffs that have become central to his economic agenda, and he has dismissed turbulence in financial markets and price increases from the levies as a disturbance necessary to realign the world trading order as he has envisioned.

His so-called "reciprocal tariffs," however, raised fears of a U.S. recession and drew criticism from some Republicans, who do not want to lose control of Congress in next year's mid-term elections to Democrats, who have attacked Trump's policies.

Trump delayed higher duty rates for 57 trading partners and the European Union last week, leaving most countries with a 10% tariff as they seek to negotiate trade deals with Washington.

The U.S. president, who is spending the weekend at his residence in Florida, told reporters on Friday he was comfortable with the high tariffs on China but had a good relationship with President Xi Jinping and believed something positive would come out of the trade conflict between them.

Financial markets were in turmoil again on Friday as China matched Trump's latest tariff increase on U.S. imports to 125%, raising the stakes in a trade war threatening to upend global supply chains.

U.S. stocks ended a volatile week higher, but the safe haven of gold hit a record high during the session and benchmark U.S. 10-year government bond yields posted their biggest weekly increase since 2001 alongside a slump in the dollar, signaling a lack of confidence in the U.S.

Reporting by David Lawder in Washington, Jeff Mason in West Palm Beach, Florida; Additional reporting by Ismail Shakil in Ottawa; Writing by David Lawder and Patricia Zengerle; editing by Don Durfee, Mark Heinrich and Paul Simao

https://www.reuters.com/markets/us-excl ... 025-04-12/

By David Lawder and Jeff Mason

April 12, 20257:05 PM EDT Updated a min ago

Summary

Semiconductors, flat-panel displays excluded from Trump's reciprocal tariffs

Tech company CEOs embracing Trump in second administration

Trump's 20% fentanyl-related tariffs remain on all Chinese imports

Latest tariff exclusions suggest growing awareness of consumer pain

Smartphones, laptops were largest US imports from China in 2024

WASHINGTON/WEST PALM BEACH, Florida, April 12 (Reuters) - President Donald Trump's administration granted exclusions from steep reciprocal tariffs to smartphones, computers and some other electronics imported largely from China, providing a big break to tech companies like Apple that rely on imported products.

In a notice to shippers...the U.S. Customs and Border Protection agency published a list of tariff codes excluded from the import taxes. The exclusions are retroactive to 12:01 a.m. EDT (0401 GMT) on April 5.

The U.S. CBP listed 20 product categories, including the broad 8471 code for all computers, laptops, disc drives and automatic data processing. It also included semiconductor devices, equipment, memory chips and flat panel displays.

The notice did not provide an explanation for the move, but the late-night exclusion provides welcome relief to major technology firms such as Apple (AAPL.O), opens new tab, Dell Technologies (DELL.N), opens new tab and many other importers.

Trump's action also excludes the specified electronics from his 10% "baseline" tariffs on goods from most countries other than China, easing import costs for semiconductors from Taiwan and Apple iPhones produced in India.

Wedbush Securities analyst Dan Ives called the announcement "the most bullish news we could have heard this weekend."

"There is still clear uncertainty and volatility ahead with these China negotiations.... Big Tech firms like Apple, Nvidia, Microsoft and the broader tech industry can breathe a huge sigh of relief this weekend into Monday," Ives said in an industry note.

Many tech company CEOs have embraced Trump as he begins his second term, attending his January 20 inauguration in Washington and celebrating with him afterward. Apple CEO Tim Cook hosted a pre-inaugural ball and has visited Trump at his home in Florida.

For the Chinese imports, the exclusion only applies to Trump's reciprocal tariffs, which climbed to 125% this week, according to a White House official. Trump's prior 20% duties on all Chinese imports that he said were related to the U.S. fentanyl crisis remain in place.

But the official said Trump will launch a new national security trade investigation into semiconductors soon that could lead to other new tariffs.

White House spokesperson Karoline Leavitt said in a statement that Trump has made clear the U.S. cannot rely on China to manufacture critical technologies such as semiconductors, chips, smartphones and laptops.

But she said that at Trump's direction, major tech firms, including Apple and chipmakers Nvidia (NVDA.O), opens new tab and Taiwan Semiconductor (2330.TW), opens new tab "are hustling to onshore their manufacturing in the United States as soon as possible."

Step chart showing the rising tariff rates imposed by the U.S. and China against each other since February 1.

TARIFF PAIN

The exemptions suggest an increasing awareness within the Trump administration of the pain his tariffs could inflict on inflation-weary consumers.

Even at a lower 54% tariff rate on Chinese imports, analysts predicted the price of a top-end Apple iPhone could jump to $2,300 from $1,599. At 125%, economists and analysts have said U.S.-China trade could largely halt.

Smartphones were the top U.S. import from China in 2024, totaling $41.7 billion, while Chinese-built laptops were second, at $33.1 billion, according to U.S. Census Bureau data.

Apple recently chartered cargo flights to ferry 600 tons of iPhones, or as many as 1.5 million, to the U.S. from India, after it stepped up production there in an effort to beat Trump's tariffs, Reuters reported on Friday.

Trump campaigned to win back the White House last year largely on a promise to bring down prices that, fueled by inflation that tarnished the economic reputation of former President Joe Biden and his Democratic allies.

But Trump also promised to impose the tariffs that have become central to his economic agenda, and he has dismissed turbulence in financial markets and price increases from the levies as a disturbance necessary to realign the world trading order as he has envisioned.

His so-called "reciprocal tariffs," however, raised fears of a U.S. recession and drew criticism from some Republicans, who do not want to lose control of Congress in next year's mid-term elections to Democrats, who have attacked Trump's policies.

Trump delayed higher duty rates for 57 trading partners and the European Union last week, leaving most countries with a 10% tariff as they seek to negotiate trade deals with Washington.

The U.S. president, who is spending the weekend at his residence in Florida, told reporters on Friday he was comfortable with the high tariffs on China but had a good relationship with President Xi Jinping and believed something positive would come out of the trade conflict between them.

Financial markets were in turmoil again on Friday as China matched Trump's latest tariff increase on U.S. imports to 125%, raising the stakes in a trade war threatening to upend global supply chains.

U.S. stocks ended a volatile week higher, but the safe haven of gold hit a record high during the session and benchmark U.S. 10-year government bond yields posted their biggest weekly increase since 2001 alongside a slump in the dollar, signaling a lack of confidence in the U.S.

Reporting by David Lawder in Washington, Jeff Mason in West Palm Beach, Florida; Additional reporting by Ismail Shakil in Ottawa; Writing by David Lawder and Patricia Zengerle; editing by Don Durfee, Mark Heinrich and Paul Simao

https://www.reuters.com/markets/us-excl ... 025-04-12/

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Are these 2 indicators of a bearish market to come? Is China dumping US bonds? The dollar has fallen 9% in 3 months. What is causing this?

Analysts from AI:

It’s actually an unusual combination—spiking 10-year U.S. Treasury yields usually coincide with a stronger U.S. dollar, not a weaker one. So if both are happening at once (higher yields and a 9% drop in the dollar over three months), it suggests some complex or global dynamics are in play. Let’s unpack the potential causes:

⸻

Inflation Expectations & Domestic Factors • High Inflation: If investors expect inflation to stay elevated or worsen, they’ll demand higher yields to compensate for loss of purchasing power. • Stubborn Core Inflation: Even if headline inflation comes down, sticky core inflation could push yields up while hurting confidence in the dollar. • Fiscal Deficits: Concerns about ballooning U.S. deficits (especially due to stimulus, military spending, or entitlement costs) can push up yields and hurt dollar sentiment.

⸻

2. Fed Policy Divergence • Fed’s Dovish Pivot: If the Fed hints at rate cuts or pauses sooner than expected—while inflation remains high—bond yields might rise on long-term inflation fears, while the dollar drops because of lower short-term interest rate expectations. • Loss of Credibility: If markets start doubting the Fed’s ability or willingness to control inflation, that undermines the dollar and drives long-term yields higher.

⸻

3. Global Risk Sentiment & Capital Flows • Foreign Selling of Treasuries: If major holders like China or Japan start reducing their Treasury holdings, it drives yields up. At the same time, selling USD to repatriate funds weakens the dollar. • Geopolitical Events: War, trade disruptions, or global realignments could cause capital to flow away from U.S. assets, leading to both a weaker dollar and higher yields. • Risk-Off to Risk-On Shift Globally: If global markets become more risk-tolerant, investors may shift out of U.S. assets into emerging markets, weakening the dollar and pushing up yields as demand for Treasuries wanes.

⸻

4. Supply-Demand Imbalances • Large Treasury Issuance: If the U.S. Treasury floods the market with new debt (to finance deficits or economic packages), it increases supply and pushes yields up. If demand doesn’t keep pace, and especially if foreign buyers pull back, the dollar can weaken too.

⸻

5. Speculation or Technical Dynamics • Short-Dollar Positioning: Hedge funds or institutions betting against the dollar can accelerate its fall, especially if fundamentals support that view. • Curve Steepening Trades: Investors might expect long-term inflation but short-term economic weakness, causing a steepening yield curve and boosting 10-year yields even as the dollar drops.

⸻

Example Scenario:

Imagine this setup: • Inflation has cooled slightly, but not enough. • The Fed signals it will pause or cut rates soon. • Meanwhile, the U.S. announces a large spending package and massive bond issuance. • Foreign buyers hesitate, selling Treasuries. • Global investors anticipate long-term inflation and avoid the dollar.

In that world, you’d get higher 10-year yields and a weaker dollar simultaneously.

⸻

Would you like to dive into how gold or equities typically respond in a scenario like this too?

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

-

ti-amie

- Posts: 33032

- Joined: Wed Dec 09, 2020 4:44 pm

- Location: The Boogie Down, NY

- Has thanked: 6219 times

- Been thanked: 4311 times

-

Honorary_medal

Re: Business/Markets/Stocks/Economics Random, Random

Justin Wolfers

@justinwolfers.bsky.social

Follow

I just want to tip my hat to the crack team of White House economists who were able to discover--in just a few short days--that the U.S. is dependent on China for smartphones, computers and semiconductors.

@justinwolfers.bsky.social

Follow

I just want to tip my hat to the crack team of White House economists who were able to discover--in just a few short days--that the U.S. is dependent on China for smartphones, computers and semiconductors.

Soumya Rangarajan, MD, MPP

@soumya-goblue.medsky.social

Follow

Your Michigan Medicine colleagues would appreciate if you relay the message that a basic medicine we use 1000x per day in the hospital, heparin, is also dependent on China, and people will die without it

Justin Wolfers @justinwolfers.bsky.social

·

3h

Heparin is just like an iPhone, except it's a bit more compact and you use it to prevent blood clots instead.

Meanwhile in China...Soumya Rangarajan, MD, MPP @soumya-goblue.medsky.social

·

2h

I dropped my subscription to the Bezos propaganda journal, but this article talks about supply chain. Trump is threatening separate across the board tariffs on pharmaceuticals, but even some of the ingredients, devices (basic stuff like IVs and bags) are under current 125% tariffs

archive.ph/sXhfa

https://archive.ph/sXhfa

“Do not grow old, no matter how long you live. Never cease to stand like curious children before the Great Mystery into which we were born.” Albert Einstein

Who is online

Users browsing this forum: No registered users and 1 guest